Let’s be honest. For a fintech startup, the word “compliance” can feel like a lead weight. It’s the labyrinth you have to navigate before you even get to the fun part—disrupting the market. The rulebooks are thicker than old phone books, and the penalties for a misstep can be catastrophic.

But what if you could stop seeing compliance as a hurdle and start seeing it as your superpower? That’s the promise of Regulatory Technology, or RegTech. It’s the suite of tools and software that automates, simplifies, and supercharges your compliance efforts. Think of it as your GPS for the regulatory maze.

What is RegTech, Really? Beyond the Buzzword

At its core, RegTech is the smart application of technology to meet regulatory requirements. It’s about replacing manual, repetitive, and error-prone tasks with intelligent automation. We’re talking about everything from AI that sniffs out money laundering to software that manages your customer data privacy with military precision.

It’s not just a fancy spreadsheet. It’s a fundamental shift. Instead of a team of people frantically trying to keep up with new regulations, you have a system that learns, adapts, and does the heavy lifting for you. Honestly, in today’s fast-paced financial world, it’s becoming less of a “nice-to-have” and more of a “can’t-survive-without.”

The Fintech Compliance Pain Points RegTech Solves

So where does RegTech actually help? Let’s break down the biggest headaches and how technology is providing the cure.

1. The Onboarding Bottleneck: KYC and AML

Know Your Customer (KYC) and Anti-Money Laundering (AML) checks are the front door to your business. But manually verifying identities, checking sanctions lists, and assessing risk is slow. It creates friction for your genuine customers and drains your resources.

RegTech Solution: Automated identity verification. These tools use AI and document verification to confirm a user’s identity in seconds. They cross-reference global watchlists and politically exposed persons (PEP) databases continuously, flagging only the real risks for human review. The result? Faster onboarding, happier customers, and a much stronger defense against financial crime.

2. The Ever-Shifting Rulebook: Regulatory Change Management

Regulations don’t stand still. A new rule can pop up in one jurisdiction and completely change your obligations. Manually tracking these changes is like trying to drink from a firehose.

RegTech Solution: Regulatory change management platforms. These act as your radar, scanning the horizon for new and amended regulations. They use natural language processing (NLP) to read and interpret legal text, then map it directly to your internal policies and controls. You get a clear, actionable alert: “This new rule in the EU affects your transaction reporting process. Here’s what you need to do.”

3. The Data Deluge: Risk Management and Reporting

Financial regulators love data. Transaction reports, risk assessments, compliance audits—it all generates mountains of information. Pulling this data together for reports is a monumental, and frankly, soul-crushing task.

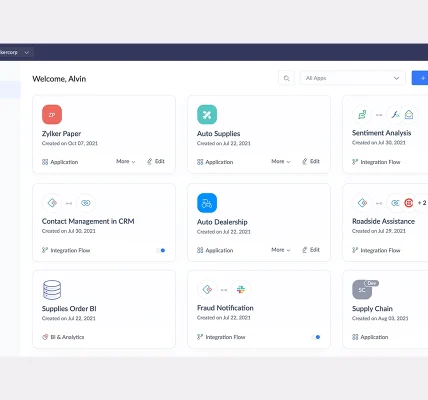

RegTech Solution: Centralized compliance dashboards and reporting automation. These platforms pull data from all your different systems—your core banking software, payment processors, you name it—and unify it. They can then generate the required reports at the click of a button. It turns a week-long scramble into a 15-minute task.

Key RegTech Solutions in Action

| Solution Category | What It Does | Real-World Impact |

| AI-Powered Transaction Monitoring | Scans transaction data in real-time to detect suspicious patterns indicative of fraud or money laundering. | Drastically reduces false positives, saving thousands of hours in investigation time and catching sophisticated schemes older systems would miss. |

| SupTech (Supervisory Technology) | Tools used by regulators themselves to monitor the market, but also used by firms to ensure their reporting is regulator-ready. | Creates a common language between fintechs and regulators, streamlining examinations and making audits less painful. |

| Compliance Process Automation | Automates workflows for tasks like employee surveillance, license management, and policy attestations. | Frees up your compliance team to focus on high-value strategic work, like interpreting complex rules, rather than administrative chores. |

Implementing RegTech: A Realistic Roadmap

Okay, you’re sold. But how do you actually bring this into your company without causing a meltdown? Here’s a practical approach.

- Audit Your Pain. Don’t just buy tech for tech’s sake. Start with your most painful, time-consuming, or risky compliance process. Is it KYC? Regulatory reporting? Start there.

- Check for Compatibility. The shiniest tool is useless if it doesn’t play nice with your existing core systems. Integration capabilities are key. You know, make sure the new piece actually fits the puzzle.

- Think Scalability. You’re a fintech—you plan to grow. Choose a solution that can grow with you, handling more volume, more products, and expansion into new markets.

- Don’t Forget the Humans. RegTech augments your team; it doesn’t replace them. Invest in training. Your compliance officers need to understand how the tool works to trust its findings and manage its exceptions.

The Future is Integrated and Intelligent

Looking ahead, RegTech isn’t just getting smarter; it’s getting more deeply woven into the fabric of finance. We’re moving towards what some call “Embedded Compliance,” where regulatory checks are seamlessly built into the product experience itself. A loan application process, for instance, would automatically perform its necessary checks in the background, invisible to the user.

Furthermore, the rise of predictive analytics will see RegTech moving from a reactive to a proactive stance. Systems won’t just flag current issues; they’ll forecast future risks based on market trends, geopolitical events, and emerging regulatory patterns.

That said, the goal isn’t a fully automated, human-less compliance department. The goal is a powerful partnership. The machine handles the volume and the velocity, while the human provides the context, the judgment, the nuance. It’s about leveraging technology to be not just compliant, but truly resilient.

In the end, the most successful fintechs won’t be the ones that simply follow the rules. They’ll be the ones that use technology to understand them, master them, and build trust upon them. And that, you know, is a competitive advantage no one can regulate away.